What Is Common Net Worth: Understanding Your Financial Standing

Have you ever stopped to consider what your financial picture really looks like? It's almost a universal curiosity, isn't it? Many people, quite naturally, wonder where they stand compared to others when it comes to money. This curiosity often leads to questions about what is common net worth, a figure that offers a snapshot of your financial health. Knowing this figure for yourself, and what it means for most people, can give you a better sense of your own money journey.

For a lot of us, talking about money feels a bit private, perhaps even a little awkward. Yet, there's a real desire to grasp if we are, in some way, keeping pace with our peers. This isn't about judging anyone's personal situation, but more about gaining a clearer view of the financial landscape. It helps to have a general idea of what folks typically possess in terms of assets versus debts.

Understanding what is common net worth really helps you see your own financial path more clearly. It is that, a way to measure your economic progress, giving you a benchmark, so to speak. This article will break down what net worth means, how you can figure out your own, and what figures are generally seen as typical for different groups. It's a way to feel more confident about your money decisions.

Table of Contents

- Common, the Artist: A Figure of Shared Experience

- What Exactly Is Net Worth?

- Calculating Your Own Net Worth: A Simple Approach

- Why Knowing Your Net Worth Matters

- The Idea of Common Net Worth: Average Versus Median

- Factors That Influence Net Worth

- How to Improve Your Net Worth: Practical Steps

- Frequently Asked Questions About Net Worth

Common, the Artist: A Figure of Shared Experience

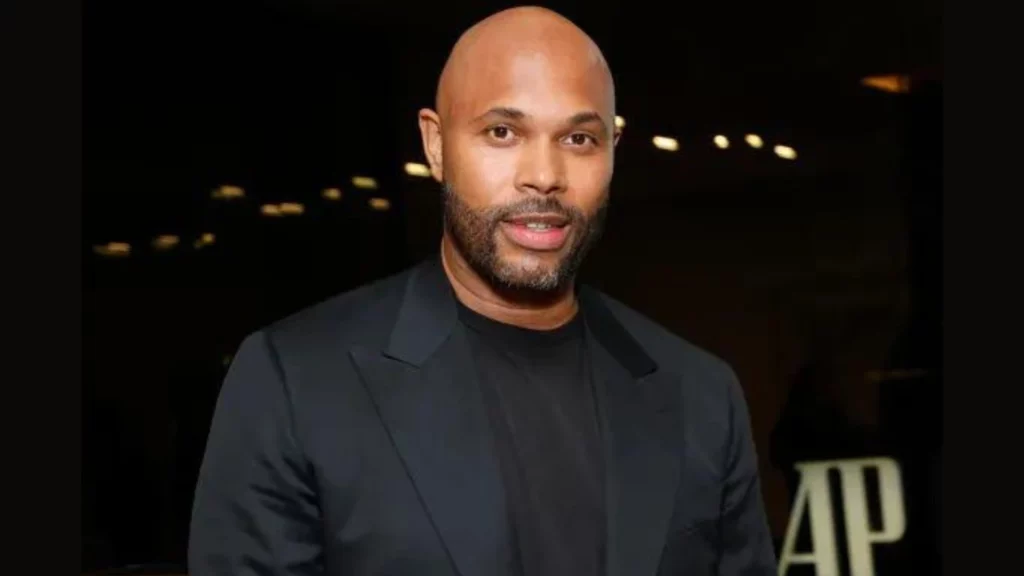

When we talk about "common," it can mean a lot of things, can't it? It might mean something that happens often, or something that is widely known. Interestingly, the term also applies to someone quite famous, a well-known individual who has touched many lives through their work. This person is Lonnie Rashid Lynn, born March 13, 1972, and known professionally as Common, formerly Common Sense. He is an American rapper and an actor, too. He has received three Grammy Awards, among other honors. He was born in Chicago, and, you know, he's the son of a school principal and a basketball player. This artist’s name, Common, in a way, speaks to the shared human experience he often explores in his music and acting. He really is someone many people know.

The meaning of common, as a word, is of or relating to a community at large. It applies to what is accustomed, usually experienced, or inferior, to the opposite of what is exclusive or aristocratic. The park, for instance, is used by the common people. It means the same in a lot of places or for a lot of people. It can even mean the basic level of politeness that you might expect. Common applies to what takes place often, is widely used, or is well known, like the common dandelion a botanist might study. The term also implies coarseness or a lack of distinction. If something is common to two or more people or groups, it is done, possessed, or used by them all, like Moldavians and Romanians sharing a common language. The common, that which is common or usual, can refer to the common good, the interest of the community at large, or even the corporate property of a burgh in Scotland. There are seventeen meanings listed in OED's entry for the noun common, eleven of which are labeled obsolete. This idea of something being "common" or widely shared, much like the artist Common's widespread recognition, helps us think about what "common" means in the context of personal finance.

Personal Details and Bio Data of Common (Lonnie Rashid Lynn)

| Full Name | Lonnie Rashid Lynn |

| Known Professionally As | Common (formerly Common Sense) |

| Date of Birth | March 13, 1972 |

| Place of Birth | Chicago, Illinois, USA |

| Profession | Rapper, Actor |

| Notable Achievements | Recipient of three Grammy Awards, among others |

| Parents | Dr. Mahalia Ann Hines (mother), Lonnie Lynn (father) |

What Exactly Is Net Worth?

Net worth, very simply, is a way to figure out your financial health. It shows the total value of everything you own, minus everything you owe. It’s like taking a snapshot of your finances at a specific moment. This number can be positive, if you own more than you owe, or negative, if your debts are larger than your assets. It gives you a pretty clear picture of where you stand financially, you know, right now.

Think of it as a balance sheet for your personal life. It includes all your assets, which are things of value that you own. Then, it subtracts all your liabilities, which are the debts you have. The result is your net worth. It’s a pretty basic calculation, but it reveals a lot about your financial standing.

Assets can be many different things. They might include cash in your bank accounts, savings, investments like stocks or bonds, retirement funds, real estate you own, or even valuable personal items. Liabilities are also varied. They could be credit card balances, student loans, car loans, mortgages, or any other money you owe to others. So, it's really about getting all those numbers together.

Calculating Your Own Net Worth: A Simple Approach

Calculating your net worth is actually quite straightforward, so it's almost something anyone can do. You just need to gather some information about your money. The basic formula is very simple: Assets minus Liabilities equals Net Worth. It is that easy to start with, anyway.

First, make a list of all your assets. This would include the money you have in checking and savings accounts. Then, add any investments you hold, like stocks, bonds, or mutual funds. Don't forget your retirement accounts, such as a 401(k) or IRA. If you own a home or other real estate, list its current market value. Also, think about any other valuable possessions you have, like a car or expensive jewelry, though sometimes these are left out for simplicity. Get a good estimate of their worth, too.

Next, list all your liabilities. This means any money you owe. Common liabilities include credit card debt, student loans, car loans, and your mortgage balance. If you have any personal loans or other outstanding bills, include those as well. Be thorough here, because every bit of debt counts against your net worth. It's really about getting a complete picture of what you owe.

Once you have both lists, add up the total value of your assets. Then, add up the total amount of your liabilities. Finally, subtract your total liabilities from your total assets. The number you get is your net worth. It's a snapshot, remember, and it can change often, so it's good to check it periodically, perhaps once a year, or even more frequently if you are making big financial moves. This simple calculation gives you a powerful tool for financial planning, you know.

Why Knowing Your Net Worth Matters

Knowing your net worth is pretty important for a few good reasons, actually. It gives you a clear picture of your financial standing. Without this number, it's a bit like driving without a speedometer; you might be moving, but you don't really know how fast or where you are going financially. It helps you see your progress over time, which is very motivating.

One big reason it matters is for tracking progress. When you calculate your net worth regularly, you can see if it's growing or shrinking. If it's growing, that's a good sign that your financial choices are working. If it's going down, it might signal that you need to adjust your spending or saving habits. It’s a bit like a personal financial report card, really.

It also helps with setting financial goals. If you want to buy a house, retire comfortably, or save for a child's education, knowing your current net worth helps you figure out how far you have to go. It makes your goals feel more concrete and achievable. You can then make a plan to increase that number over time. This is a very practical way to approach your money, too.

Furthermore, understanding your net worth can reduce financial stress. When you have a clear view of your money situation, you feel more in control. This clarity can help you make better decisions, like whether to take on more debt or if it's a good time to invest. It gives you a sense of direction, which can make a big difference in how you feel about your money, you know, overall.

The Idea of Common Net Worth: Average Versus Median

When people ask "what is common net worth," they are often looking for a benchmark. They want to know what most people have, or what is typical. However, there are two main ways to look at this: average net worth and median net worth. Understanding the difference between these two is pretty important, as they tell very different stories about what's "common."

The average net worth is calculated by adding up everyone's net worth in a group and then dividing by the number of people in that group. This figure can be easily skewed by a few very wealthy individuals. For example, if you have ten people, and nine have a net worth of $50,000, but one person has $10 million, the average will be very high. This high average might not truly reflect what most people in the group actually possess. It's just a mathematical mean, you know, that might not show the typical person's situation.

Median net worth, on the other hand, gives a much better idea of what is truly common. To find the median, you list everyone's net worth from lowest to highest. The median is the number exactly in the middle of that list. If there are two middle numbers, you average them. The median is less affected by extreme high or low values. So, if that one person with $10 million is in the group, the median would still show something closer to the $50,000 that most people have. This figure is generally a more realistic representation of what the typical person has in terms of wealth. It really tells you what's more usual for a lot of people.

So, when you see figures about "common net worth," it's usually more helpful to look at the median. The median gives you a truer sense of what the middle-of-the-road person has accumulated. It's a more accurate reflection of general financial standing for a lot of people, so it's a better benchmark for most individuals. For instance, the Federal Reserve typically publishes these kinds of figures, and they often highlight both average and median to give a full picture. Learn more about personal finance benchmarks on our site, as this can help you compare your own situation.

Factors That Influence Net Worth

Many things can affect a person's net worth, you know. It's not just about how much money you make. Several factors play a big part in how much wealth someone accumulates over time. Understanding these can help you think about your own financial path and what might be influencing your numbers. It's a rather complex mix of elements, actually.

Age is a significant factor. Generally, as people get older, their net worth tends to increase. This is because they have more time to save, invest, and pay down debts like mortgages. Younger people are often just starting out, perhaps with student loans or just beginning their careers, so their net worth might be lower or even negative. This is pretty typical, in a way, for those just getting started.

Income level, of course, plays a role. Higher incomes generally allow for more saving and investing, which can lead to a higher net worth. However, it's not just about how much you earn; it's also about how much you keep. Someone with a moderate income who saves a lot might have a higher net worth than someone with a high income who spends everything they make. So, income is a piece of the puzzle, but not the only piece, you know.

Education level often correlates with net worth. People with higher levels of education often have higher earning potential, which, as mentioned, can contribute to greater wealth accumulation. This is a general trend, of course, and there are always exceptions. Still, education can open doors to higher-paying jobs, which helps build assets over time.

Spending habits are extremely important. Someone who lives below their means, saving and investing a portion of their income, will likely build wealth faster than someone who spends everything they earn, regardless of income level. It's about making conscious choices with your money. This is where personal discipline really comes into play, you know, for building wealth.

Investment choices also make a big difference. Smart investing can significantly grow your assets over time through compound interest and market gains. On the other hand, poor investment decisions or not investing at all can limit wealth growth. It's about putting your money to work for you, rather than just letting it sit there. This is where financial literacy can really help, too.

Debt management is another key factor. High levels of consumer debt, like credit card balances, can really drag down your net worth. Paying off high-interest debt quickly frees up money that can then be saved or invested, which helps your net worth grow. It's about reducing those liabilities as much as possible, you know.

Economic conditions also play a part. Things like inflation, interest rates, and the performance of the stock market can affect the value of your assets and the cost of your debts. These are factors largely outside of your control, but they can still impact your net worth. It's something to be aware of, even if you can't change it directly.

Life events, such as marriage, divorce, having children, or unexpected medical expenses, can also have a substantial impact on net worth. These events can either boost or deplete your financial resources, depending on the circumstances. They are, in a way, moments that can really shift your financial picture, for better or worse. So, it's pretty clear that many things are at play when we talk about what builds or diminishes a person's net worth.

How to Improve Your Net Worth: Practical Steps

If you're looking to increase your net worth, which many people are, there are some very practical steps you can take. It's not always about making a lot more money right away; sometimes, it's more about how you manage the money you already have. These steps, you know, can really help you move in the right direction.

First, focus on reducing your debt. High-interest debts, especially like credit card balances, can really eat away at your money. Paying these off aggressively frees up cash flow and reduces your liabilities. Consider strategies like the debt snowball or debt avalanche method. It's about getting rid of those financial burdens, so you can build up your assets more effectively.

Next, increase your savings. Try to save a portion of every paycheck, even if it's a small amount to start. Automate your savings by setting up automatic transfers from your checking to your savings account. This makes saving consistent and less likely to be forgotten. Over time, these consistent savings really add up, you know, quite significantly.

Invest wisely. Once you have an emergency fund built up and high-interest debt under control, start investing. This could mean contributing to a retirement account like a 401(k) or IRA, or investing in a diversified portfolio of stocks and bonds. Investing allows your money to grow over time, potentially much faster than just keeping it in a savings account. It's about making your money work for you, which is very important for long-term wealth growth.

Look for ways to increase your income. This could involve asking for a raise at your current job, taking on a side hustle, or starting a small business. Even a little extra income can make a big difference if you use it to pay down debt or invest. It's about finding opportunities to bring in more money, so you have more resources to build your net worth.

Manage your expenses carefully. Create a budget and stick to it. Track where your money goes so you can identify areas where you might be overspending. Cutting unnecessary expenses frees up more money for saving and investing. It's not about depriving yourself, but about making conscious choices about your spending, you know, every day.

Consider your housing situation. For many people, their home is their largest asset, but also their largest liability. If you have a mortgage, paying it down can significantly increase your equity, which boosts your net worth. Also, consider if your housing costs are too high for your income. Sometimes, adjusting your living situation can free up a lot of money. It's a big decision, of course, but it can have a huge impact.

Educate yourself about personal finance. The more you know about money management, investing, and financial planning, the better decisions you can make. Read books, listen to podcasts, or take online courses. Knowledge is very powerful when it comes to building wealth. It's about empowering yourself with information, really.

Regularly review your net worth. Make it a habit to calculate your net worth at least once a year. This helps you track your progress, celebrate successes, and identify areas where you might need to adjust your strategy. It keeps you accountable and focused on your financial goals. This consistent check-in is very helpful, you know, for staying on track. You can find more helpful tips on personal finance strategies to help you grow your wealth.

Frequently Asked Questions About Net Worth

People often have similar questions when they think about their net worth. Here are some common ones that come up, you know, quite a lot.

What is considered a good net worth for my age?

There isn't one single "good" number that fits everyone, really. What's considered good often depends on many things, like your income, where you live, and your personal goals. Generally, a positive and growing net worth is a good sign. Median net worth figures by age group, often published by organizations like the Federal Reserve, can offer a benchmark. For example, a person in their 30s might aim for a net worth equal to their annual salary, while someone closer to retirement would hope for a much higher number to support their later years. It's more about your personal trajectory than hitting an exact figure, you know.

Does net worth include my house?

Yes, absolutely. Your house is typically a significant asset in your net worth calculation. You include the current market value of your home as an asset. However, you also must include any outstanding mortgage balance as a liability. So, it's not just the full value of the house, but your equity in it (the market value minus what you still owe) that truly contributes to your net worth. This is a very important distinction, really, for an accurate calculation.

Is it possible to have a negative net worth?

Yes, it is definitely possible to have a negative net worth, especially for younger people or those with significant student loan debt. If your total liabilities (what you owe) are greater than your total assets (what you own), then your net worth is negative. This is pretty common for many individuals starting out, you know, with college loans or just beginning their careers. The goal, then, is to work towards making that number positive and growing it over time. It's a starting point, not a final destination.

Common's net worth (2025), age, height, wife, does he have any kids

Jonathan Lawson Net Worth | Colonial Penn, Age, Biography

Common Has Some Opinions About His Rival, Drake